Insurance Planning

“Retirement Insurance” Summary:

The Top (6) Retirement Risks

“Retirement Insurance” Summary:

The Top (6) Retirement Risks

Risk #1

Large Pre-tax Retirement accounts are a TAX LIABILITY to your Heirs

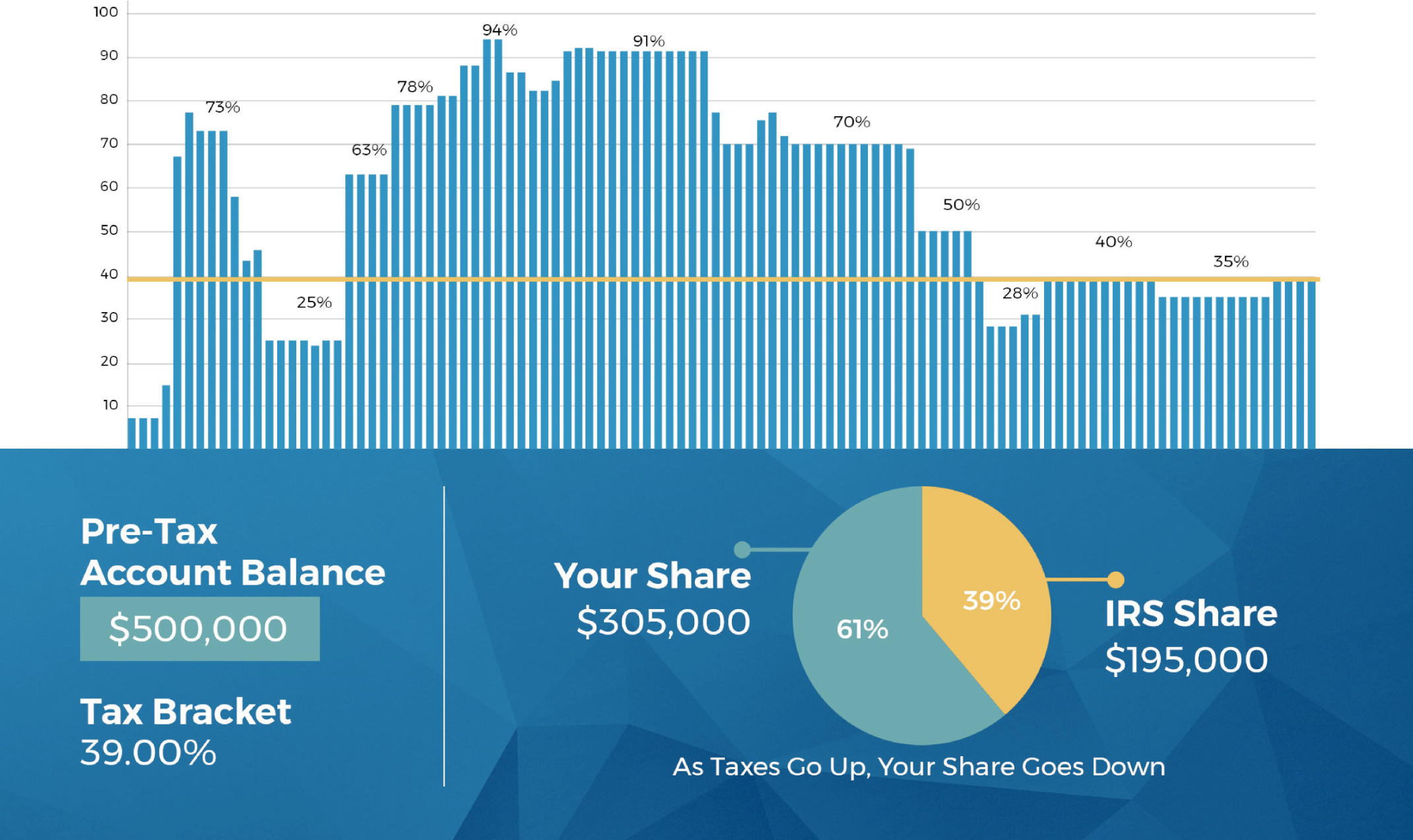

Risk #2

Large Pre-tax Retirement accounts are a TAX RISK during Retirement

Risk #3

Large Pre-tax Retirement accounts cannot be “Borrowed From”

Risk #4

“Inflation” Risks can prematurely DRAIN

Retirement accounts

Risk #5

“Longevity” Risks can prematurely DRAIN

Retirement accounts

Risk #6

Accidents and Illnesses can prematurely DRAIN Retirement accounts

Top Tax Brackets Since 1913

Benefit #1 Death Benefit

Available Death Benefit that may be paid to your loved ones tax free.

At Passing, your Heirs receive a “Tax Free” inheritance. The “Death Benefit” Component is also the key enabler to the preferential IRS Tax treatment. (IRS Code #7702)

Benefit #2 Cash Values

Buy a Boat or RV, or buy Investment Properties for children to inherit, or emergency

Policy "Cash Values" Grow "Tax Deferred"

Cash Values can be accessed anytime through "Policy Loans" or Withdrawals.

Risk Mitigation #1 Health Emergencies

You cannot plan for “Unexpected” health emergencies, but you can plan to protect against their Unexpected Costs

Examples of “QoL” Quality of Life Coverages where death benefit can be “Pulled Forward” to preserve other assets:

Long Term Care

Major Heart Attack

Coronary Artery Bypass

Stroke

Invasive Cancer

Major Organ Transplant

End Stage Renal Failure

Paralysis

Coma

Severe Burn

Etc...

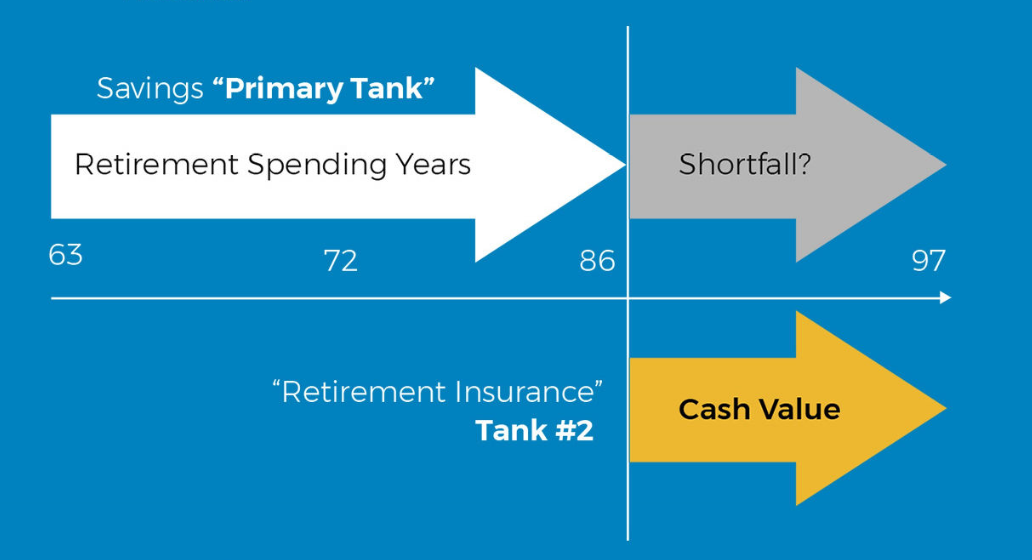

Risk Mitigation #2 Outliving Your Money

Inflation, Taxation, Pharmacy costs, etc. are beyond your control, so plan to protect, just in case.

The “Two Tank” Retirement Savings Plan

If (or When) retirement savings are depleted, the Cash Value in the Policy can be "Activated" to create "Tax Efficient" annual income if needed